The United States and Britain have sanctioned more than 100 companies and individuals associated with a Cambodia-based ethnic-Chinese network operating online investment scam centres and cyber heists across Asia in countries like Laos, North Korea and the South Pacific island nation of Palau.

The sanctions, announced simultaneously in Washington and London on October 14, are being imposed by the US Treasury’s Office of Foreign Assets Control ( Ofac ) and the Financial Crimes Enforcement Network ( FinCEN ) along with the UK’s Foreign, Commonwealth and Development Office ( FCDO ).

“The rapid rise of transnational fraud has cost American citizens billions of dollars, with life savings wiped out in minutes,” says Scott Bessent, the US Treasury secretary. “Treasury is taking action to protect Americans by cracking down on foreign scammers.

“Working in close coordination with federal law enforcement and international partners like the United Kingdom, Treasury will continue to lead efforts to safeguard Americans from predatory criminals.”

London properties frozen

British sanctions include freezing businesses incorporated in the British Virgin Islands and property investments in London.

“The masterminds behind these horrific scam centres are ruining the lives of vulnerable people and buying up London homes to store their money,” notes Yvette Cooper, the UK foreign secretary. “Together with our US allies, we are taking decisive action to combat the growing transnational threat posed by this network – upholding human rights, protecting British nationals and keeping dirty money off our streets.”

UK properties affected include, according to a UK foreign office statement, a £12 million ( US$16.04 million ) mansion on Avenue Road in North London, a £100 million office building on Fenchurch Street in the City of London and 17 flats on New Oxford Street and Nine Elms in South London.

Scam centres across Southeast Asia, the statement adds, “are using sophisticated schemes, including scams in which people are lured into fake romantic relationships, to defraud victims on an industrial scale. Those conducting the scams are often trafficked foreign nationals, trapped and forced to carry out online fraud under threat of torture.”

The sanctions, UK fraud minister Lord Hanson shares, “prove our determination to stop those who profit from this activity and hold offenders accountable. Through our new, expanded fraud strategy we will go even further to disrupt corrupt networks and protect the public from shameless criminals. […] Fraudsters prey on the most vulnerable by stealing life savings, ruining trust and devastating lives. We will not tolerate this.”

Prince Group targets

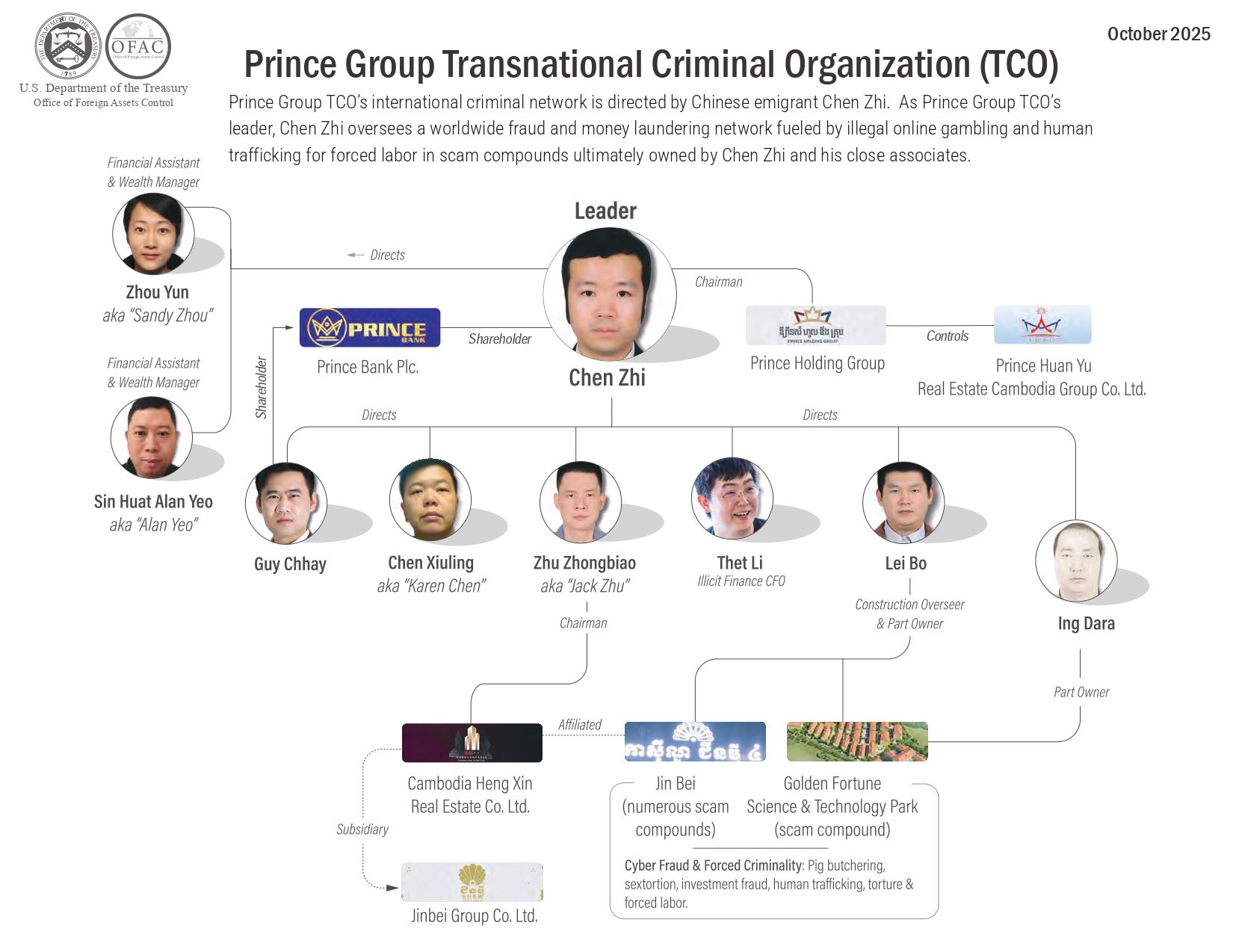

The Ofac, the US Treasury statement points out, has imposed sanctions on 146 targets within the Prince Group – described as a transnational criminal organization led by 38-year-old Chinese émigré Chen Zhi, who has acquired Cambodian citizenship.

Through Prince, Chen “co-mingles illicit revenues with the legitimate Cambodian economy,” the Treasury states, “laundering these ill-gotten gains through a complicated network of over 100 shell and holding companies all around the world.”

Criminal revenues generated by Prince Group have been “instrumental in supporting its ostensibly legitimate business ventures” – notably a bank and real estate company.

In addition, FinCEN, the Treasury points out, is severing Cambodia-based financial services conglomerate Huione Group from the US financial system.

US losses to online investment scams, the Treasury estimates, are US$16.6 billion “over the last several years” and at least US$10 billion last year – up two-thirds from a year earlier.

“Over the course of the past decade, transnational organised criminal groups, like Prince Group […] have established profitable cyberfraud operations across Southeast Asia, particularly in Cambodia,” the Treasury statement shares. “Prince Group remains a dominant player in Cambodia’s scam economy and has controlled illicit financial flows of billions of dollars.”

The foreign office in London, the Treasury adds, has concurrently imposed sanctions on Prince Holding Group, Chen Zhi and his key associates.

Moreover, “today’s bilateral sanctions actions are accompanied by the unsealing of a criminal indictment in the US District Court for the Eastern District of New York against Chen Zhi,” it notes. “This coordinated action is the result of close coordination between the Federal Bureau of Investigation ( FBI ), the US Attorney’s Office for the Eastern District of New York, as well as the UK’s FCDO.”

North Korean cyber heists

On Huione Group being severed from the US financial system, the Treasury says, the group is a “critical node for laundering proceeds of cyber heists” by North Korea and for “pig butchering” scams by transnational criminal organizations, adding that it had “laundered at least US$4 billion worth of illicit proceeds between August 2021 and January 2025.”

Of this, it laundered at least US$37 million in virtual currency from North Korean cyber heists, at least US$36 million from virtual currency investment scams and US$300 million in virtual currency from other cyber scams.

“Covered financial institutions are now prohibited from opening or maintaining correspondent accounts for or on behalf of Huione Group,” the Treasury notes, adding that they are also required to take ”reasonable steps not to process transactions for the correspondent account of a foreign banking institution in the United States, if such a transaction involves Huione Group.”

Litany of transnational crimes

As for Prince Group, the Ofac has designated a network of 117 affiliated businesses – mostly offshore shell companies that engage in no apparent real commercial or business activity – and an associated official.

Prince’s “burgeoning operations” in Palau where it has leased an island and set up resorts have also been targeted by the Treasury, which states that overall the group “profits from a litany of transnational crimes, including sextortion […] money laundering, various frauds and rackets, corruption, illegal online gambling, and the industrial-scale trafficking, torture and extortion of enslaved workers in furtherance of the operation of at least 10 scam compounds in Cambodia.

“In these compounds, workers are often lured by the promise of well-paid jobs in customer service, tech support, and related fields, but are instead held against their will and made to scam people from around the world in so-called ‘pig butchering’ and other fraud schemes.

“These schemes involve cultivating, sometimes over the course of months, elaborate relationships with victims, gaining their trust and confidence, then inducing them to ‘invest’ funds in fraudulent investment platforms ultimately controlled by scammers.

“The butchering comes when the scammers go dark after taking every dollar they can from their victims.”

Scam centres in Cambodia, Myanmar and across the region, the British foreign office notes in its separate statement, run their operations from disused casinos or purpose-built compounds.

Jin Bei Group

Some of Prince’s “most notorious” scam compounds, according to the US Treasury, are under the umbrella of Jin Bei Group – a luxury hotel and casino company.

Jin Bei, it says, “also operates a series of compounds throughout Cambodia linked to reports of extortion, scamming, forced labour and the gruesome murder of 25-year-old Chinese national Yi Ming Dali in 2023.”

In the takedown of a Chinese money-laundering network in New York in 2022, the FBI identified 259 Americans who lost US$18 million to scammers at Jin Bei. “This sum represents just one takedown of one network associated with the scam compounds,” the Treasury shares, “and is only a fraction of total losses inflicted on US persons by this group.”

Chen, according to the Treasury, works closely with vice-chairmen and financial assistants who manage Prince Holding Group’s various subsidiaries.

Among the individuals targeted by sanctions are Guy Chhay, Lei Bo, Ing Dara, Zhu Zhongbiao ( aka Jack Zhu ), Sin Huat Alan Yeo ( aka Alan Yeo ), Zhou Yun ( aka Sandy Zhou ), Chen Xiuling ( aka Karen Chen ), Wei Qianjiang and Thet Li ( see chart ).

Zhu, who chairs a Jin Bei subsidiary, Heng Xin Real Estate Investment Company, the Treasury states, “is wanted by Chinese law enforcement for charges related to money laundering”.

Chen Xiuling meanwhile oversees Prince Holding Group companies based in Mauritius, Taiwan and Singapore, and Wei is in charge of Warp Data Technology Lao Sole Company – a Laos-based bitcoin-mining operation – a venture that the Treasury points out, “has funnelled large quantities of bitcoin into wallets controlled by Chen Zhi”.

Under the sanctions, the Ofac designates Prince as “a significant transnational criminal organization” with individuals and companies also designated for acting on its behalf.

Burgeoning Palau operations

On its Palau activities, Prince, the Treasury says, has been setting up a luxury resort with Wang Guodan ( aka Rose Wang ) through an affiliate – Grand Legend International Asset Management.

Wang is described as a Palau-based hotel owner who’s helped Grand Legend with local administrative affairs and in getting a 99-year lease on island known as Ngerbelas. She is also vice-president of Palau’s Overseas Chinese Federation.

“In 2018,” the Treasury points out, “Rose Wang introduced the notorious criminal boss Wan Kuok Koi ( aka Broken Tooth ), who was attempting to set up casinos in Palau, to the then-president of Palau.”

In 2020, the Ofac sanctioned Broken Tooth for “spreading crime and corruption across Southeast Asia and Palau”.

It is now sanctioning two Palau companies owned by Wang – hotel and restaurant operator Jing Pin and bottle water company Aqua Pure Water.

The Ofac is also designating Grand Legend for acting on behalf of Chen Zhi – along with Wang and individuals associated with the company, namely Chen Xiao’er, Yang Jian, Yang Yanming, Shih Ting-su, Michelle Reishane Wang and Huang Chieh.

“The ultimate goal of sanctions,” the Treasury states, “is not to punish, but to bring about a positive change in behaviour.”