Hong Kong dollar ( HKD ) depositors are prioritizing liquidity over yield as they adapt to a lower interest rate environment in anticipation of further rate cuts in the coming months.

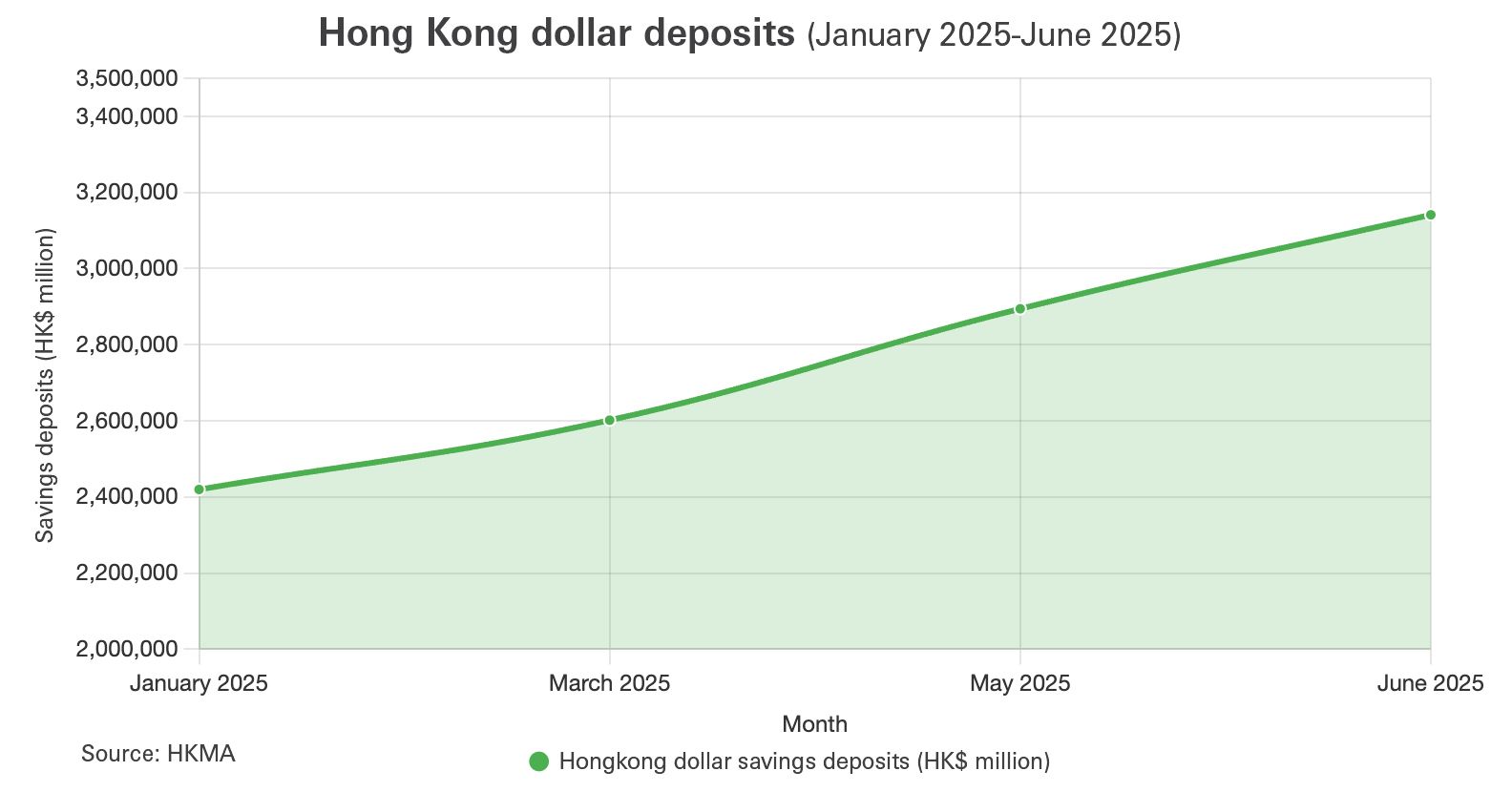

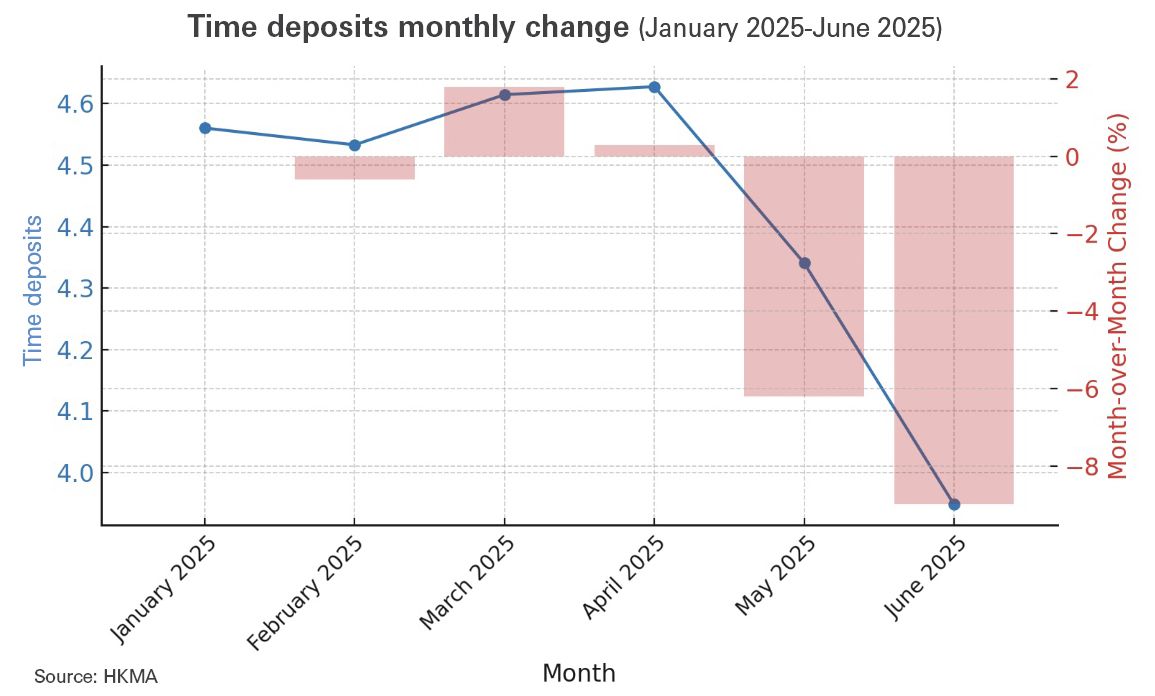

This is evident in the robust growth in HKD savings deposits versus a corresponding decline in time deposits from January to June 2025, reflecting broader trends in Hong Kong’s banking sector, particularly the falling Hong Kong interbank offered rate ( Hibor ) and substantial liquidity in the system.

In June, HKD savings deposits reached HK$3.14 trillion ( US$400 billion ), a robust 30% growth from HK$2.41 trillion in January. During the same period, HKD time deposits declined 13.4% from HK$4.56 trillion to HK$3.95 trillion, according to the latest data from the Hong Kong Monetary Authority ( HKMA ).

“This trend reflects depositors’ preference for more liquid options amid falling interest rates and economic uncertainties,” says a banker who requested anonymity.

Time deposits, which are fixed-term accounts offering higher interest rates but with penalties for early withdrawal, have seen a consistent decline, with the decline accelerating in May and June.

Downward trend

The sharp decline in time deposit volumes mirrors the downward trend in the Hibor, which has compressed the rate differential between time deposits and savings accounts. With the reduced incentive to lock in funds, depositors have increasingly shifted towards savings accounts, contributing to the drop in fixed-term balances.

The one-month Hibor rate plunged significantly between January and June 2025, roughly by 340-350 basis points, with the falls heavily concentrated in May following aggressive liquidity injections by the HKMA. The one-month Hibor dropped from 4.07% on April 29 to 0.57% by May 26, and to 0.96% by August 8.

The three-month Hibor followed a similar path, declining to 1.63% by August 8, from around 4-4.5% in the first two quarters of the year.

“HKMA’s intervention in May 2025 was primarily to defend the HK dollar’s peg to the US dollar amidst strong currency appreciation pressures,” the banker explains.

“While this move preserved the peg, it unintentionally flooded the financial system with liquidity, leading to historically low interbank rates and encouraging speculative carry trades where investors borrowed cheap HK dollars to invest in higher-yielding US dollar assets.

“The plunge in rates since May has been described as creating ‘unprecedented market conditions’, with short-term rates approaching zero, further eroding incentives for fixed-term commitments.”

Substantial liquidity

Additionally, the composite interest rate, a measure of banks' average funding costs, fell 35bp to 1.26% by the end of June, reflecting lower interbank borrowing costs, according to HKMA data.

Hong Kong’s banking sector has also maintained substantial liquidity during the January-June period, based on key indicators such as a declining loan-to-deposit ratio of about 83% in early 2025, indicating that loans are contracting while deposits are growing.

Strong liquidity buffers, along with the HKMA intervention to stabilize the HK dollar peg, are also pumping surplus liquidity into the banking system, creating a situation where banks face less pressure to attract fixed-term funds.

Going forward, there is a consensus among market analysts that the US Federal Reserve may cut rates starting in September, with multiple cuts now being anticipated until the end of the year, based on a combination of softening labour data, easing inflation concerns, and the increasingly dovish tone among Fed board members.