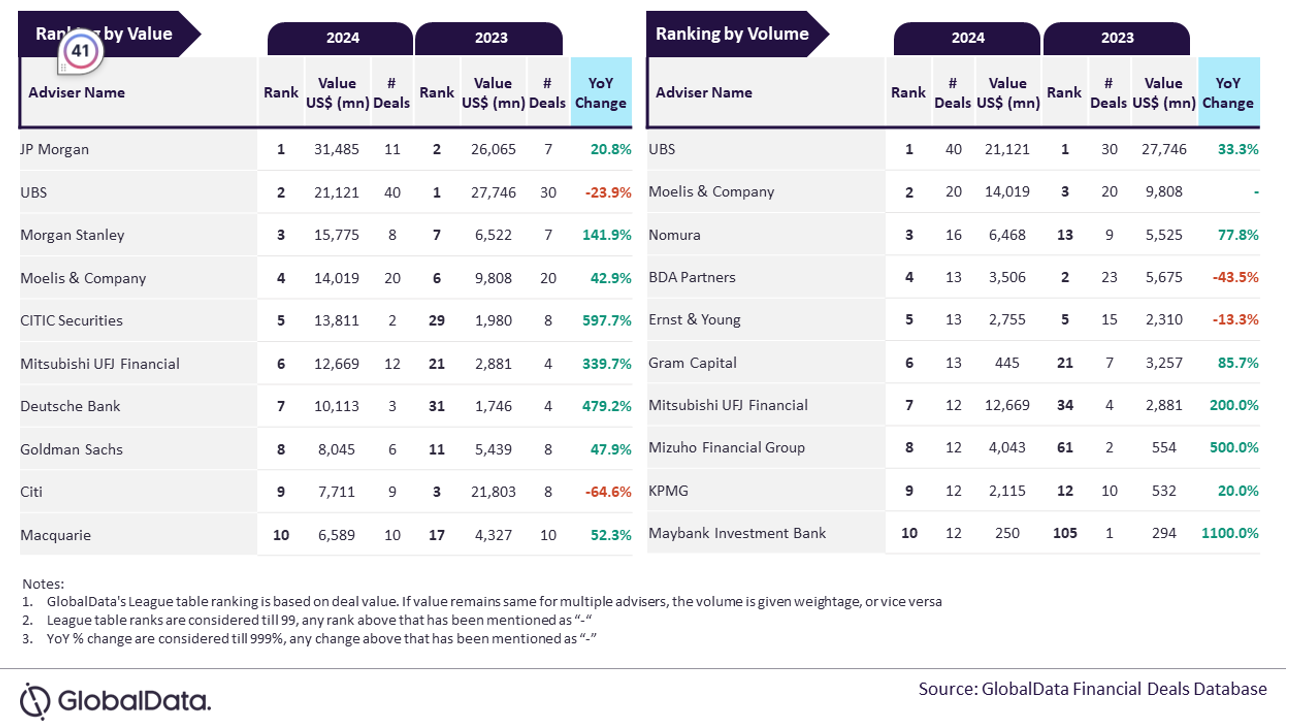

J.P. Morgan and UBS were the top mergers and acquisitions ( M&A ) financial advisers in the Asia-Pacific region in 2024 by value and volume, respectively, according to the latest financial advisers league table by data and analytics firm GlobalData.

An analysis of GlobalData’s Deals Database reveals that J.P. Morgan achieved its leading position in terms of value by advising on US$31.5 billion worth of deals. Meanwhile, UBS led in terms of volume by advising on a total of 40 deals.

UBS occupied the second position in terms of value, by advising on US$21.1 billion worth of deals, followed by Morgan Stanley with US$15.8 billion, Moelis & Company with US$14 billion and CITIC Securities with US$13.8 billion.

Moelis & Company occupied the second position in terms of volume with 20 deals, followed by Nomura with 16 deals, BDA Partners with 13 deals, and Ernst & Young with 13 deals.

Aurojyoti Bose, lead analyst at GlobalData, comments: “UBS advised on twice the number of deals compared to Moelis & Company, which ranked second. In addition to leading by volume, UBS also secured the second position by value, having provided advisory services on several high-value transactions. Notably, the firm played a key role in seven billion-dollar deals during the year.

“Meanwhile, J.P. Morgan experienced growth in the total value of deals it advised on, which propelled its ranking by value from second place in 2023 to the top position in 2024. Of the 11 deals the firm advised on, eight were billion-dollar deals. This strong involvement in high-value deals contributed to both an increase in the total deal value and an improvement in its ranking by value.”

Top legal advisers

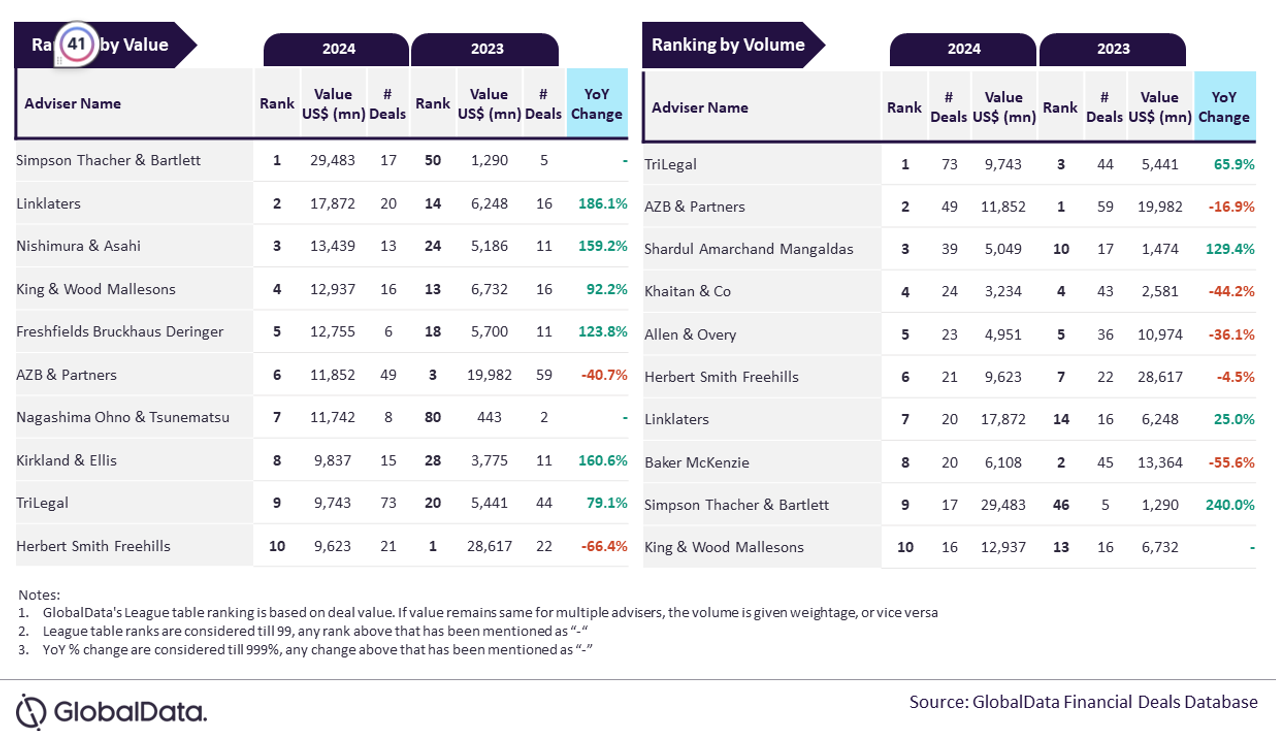

Simpson Thacher & Bartlett and TriLegal were the top M&A legal advisers in the region in 2024 by value and volume, respectively.

An analysis of GlobalData’s Deals Database reveals that Simpson Thacher & Bartlett achieved its leading position in terms of value by advising on US$29.5 billion worth of deals. TriLegal led in terms of volume by advising on a total of 73 deals.

Says Bose: “Simpson Thacher & Bartlett registered a massive jump in the total value of deals advised by it during 2024 compared to 2023. Resultantly, its ranking by value took a major leap from 50th position in 2023 to the top position in 2024. Around half of the deals advised by Simpson Thacher & Bartlett during 2024 were billion-dollar deals and the involvement in these high-value transactions helped register a jump in the total value of deals advised as well as its ranking by this metric.

“Meanwhile, TriLegal also registered improvement in the total number of deals advised by it during 2024 compared to 2023. It went ahead from occupying the third position by volume in 2023 to top the chart by this metric in 2024.”

Linklaters occupied the second position in terms of value, by advising on US$17.9 billion worth of deals, followed by Nishimura & Asahi with US$13.4 billion, King & Wood Mallesons with US$12.9 billion, and Freshfields Bruckhaus Deringer with US$12.8 billion.

AZB & Partners occupied the second position in terms of volume with 49 deals, followed by Shardul Amarchand Mangaldas with 39 deals, Khaitan & Co with 24 deals, and Allen & Overy with 23 deals.

GlobalData says its league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company says, it also seeks submissions from leading advisers, through an adviser submission forms on GlobalData, which allows both legal and financial advisers to submit their deal details.

For league tables, it has considered M&A including asset transactions, venture capital and private equity deals where advisers were involved.