After three consecutive years of increased lending activity, syndicated loan volume in Asia-Pacific ( ex-Japan ) declined 7.8% to US$536.9 billion in 2024, compared with the previous year, making the lowest annual tally since the onset of the coronavirus pandemic, according to a new report. The number of transactions also fell to 1,400 in 2024 from the previous year's tally of 1,615 which had raised a record US$582.6 billion.

The outlook for lending in the region this year remains uncertain amid concerns that the incoming administration in the United States may impose tariffs that could dampen economic growth across the world, and more particularly among key markets in Asia-Pacific ( APAC ), LSEG says.

Acquisition-related financing in 2024 totalled US$27.1 billion, increasing marginally by 3.2% from the previous year's US$26.3 billion, thanks to a surge in activity during the last quarter, data from LSEG Data and Analytics show. M&A lending in 4Q2024 stood at US$12.6 billion, nearly 4x higher than the US$3.3 billion raised in the preceding quarter. Nevertheless, the region still suffered from a thinner pipeline in terms of the number of M&A financing completed – only 45 deals in 2024 backed M&A activity, a 16.7% drop compared to 54 transacted for the same purpose last year.

Two jumbo M&A financings in the region were the highlight of 2024 – a US$4.9 billion-equivalent loan raised in the fourth quarter for Thai billionaire Sarath Ratanavadi's planned merger between Gulf Energy and telecom unit InTouch Holdings, and a A$5.5 billion ( US$3.42 billion ) four-year loan for Amidala Al FinCo supporting the leveraged buyout of data centre operator AirTrunk.

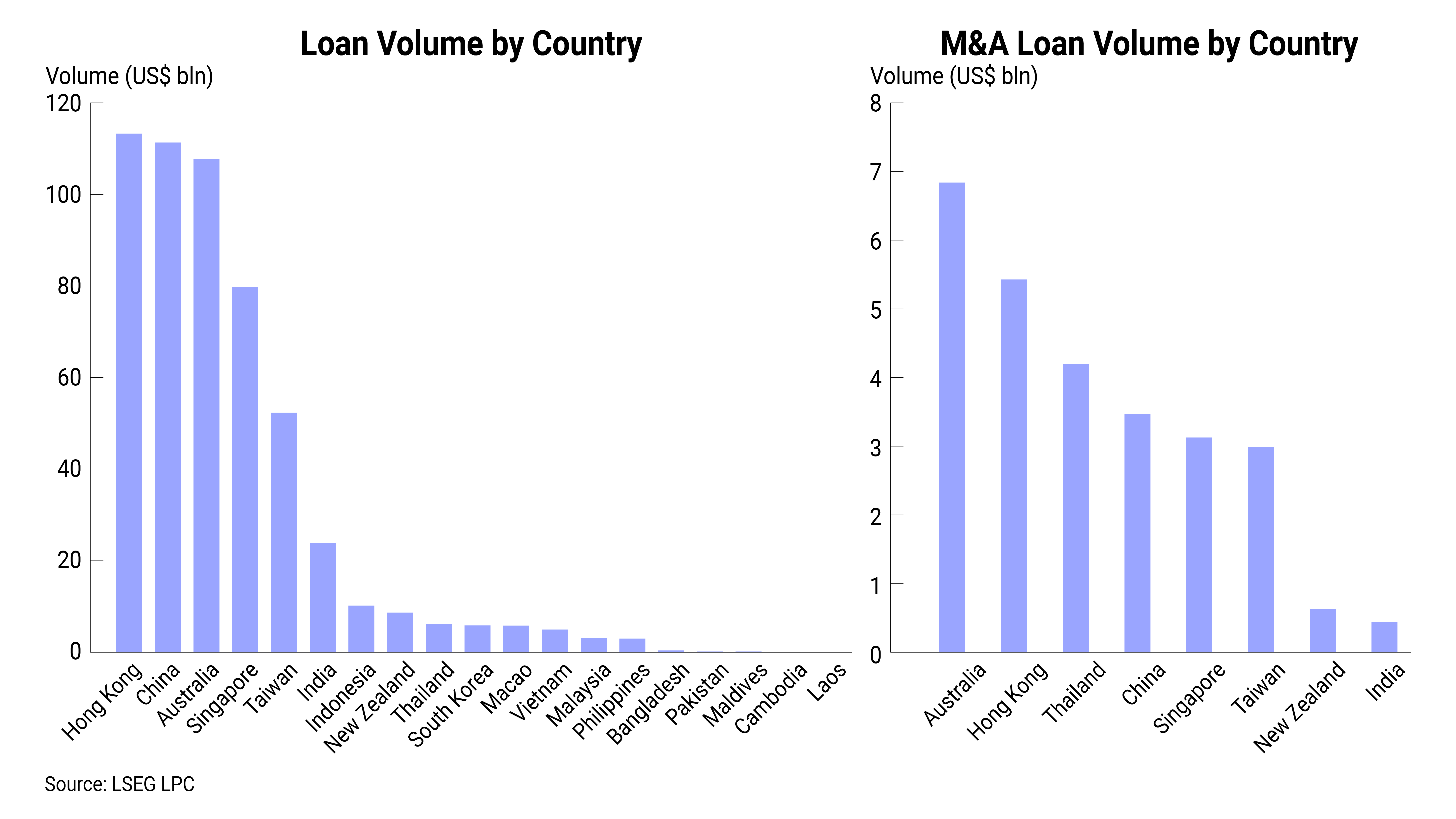

Gulf Energy's M&A loan pushed Thailand loan volumes almost 60% higher to US$6.2 billion, catapulting the country to the best-performing market in Southeast Asia.

Refinancings remained the main driver of loan volume during the year, clocking US$245.8 billion or 45.8% of total regional ending. ByteDance, the parent of short video app TikTok, completed APAC's largest loan and largest refinancing for 2024, raising a US$10.8 billion three-year financing.

Hong Kong dominated APAC ex-Japan loan volume, closing deals worth US$113.3 billion. Despite the 12.7% year-on-year jump, the territory suffered from the absence of a steady pipeline of blue-chip borrowers and muted M&A financings for much of the year, with overall market sentiment weakening after the third quarter: Loan volume in 4Q2024 sank to US$25 billion via 45 deals, from US$38 billion via 58 deals raised in the preceding three months.

In 2024, offshore loans for Chinese corporates stood at US$66.7 billion in the territory, a 19.5% jump from the US$55.8 billion posted a year ago. The increase was heavily skewed by the jumbo ByteDance financing and a US$4.5 billion sustainability-linked loan for Sinochem-owned seeds and pesticides maker Syngenta Group that marked the year’s largest such financing in the region.

China registered dismal lending activity in 2024, with volumes in the world’s second-largest economy tumbling 45.3% year-on-year to US$111.3 billion. The country has been hit by challenges, including a property crisis and weak consumer and business confidence. Appetite for new financings remained sluggish, although capital expenditure deals were the main driver, accounting for more than 65% of total volume.

In Macau, casino financings dominated the 2024 calendar as a slew of Hong Kong-listed casino operators signalled their positive outlook for the city's tourism and gaming sector. Sands China returned to the market, raising HK$32.45 billion ( US$4.17 billion ) through the largest syndicated loan from Macau in over a decade. Wynn Macau also extended a US$1.5 billion-equivalent revolver originally due in September 2025 by three years, while Studio City clubbed a five-year revolving credit of around US$300 million for refinancing.

Meanwhile, Australia logged US$107.7 billion in loan volume in 2024, jumping 47.49% over the US$73.1 billion raised in the previous year. Refinancings increased by 80% to almost US$61 billion from US$33.9 billion in 2023. A jumbo US$3.73 billion refinancing was one of three financings Macquarie Group raised during the year for a total of US$7.4 billion. Other significant deals included the A$5.5 billion leveraged buyout financing for AirTrunk and a A$4 billion 364-day facility for telecommunication services provider NBN.

Singapore was another bright spot in the region with loan volume surging 48.9% year-on-year to US$79.8 billion. The jump was largely due to borrowings totalling US$18.4 billion for commodities firms, which represented 23% of the country's total loan volume in 2024.

Other major loan markets such as India, Indonesia and Taiwan logged disappointing activity in 2024. Lending in India declined 12.6% y-o-y to US$23.9 billion in 2024, while Indonesia’s volume tumbled 67.9% to US$10.2 billion. Taiwan's tally stood at US$52.3 billion, dropping 14.5% from the previous year, although the island completed the second-largest loan of the year in Asia-Pacific – a NT$169.33 billion ( US$5.2 billion ) one-year borrowing for Taiwan Railway Bureau.

Bank of China maintained its lead over rivals, topping the 2024 APAC ex-Japan mandated arranger league table once again with DBS Bank and OCBC Bank in the second and third positions.