China’s ambition to further internationalize the use of the renminbi has continued to make progress as the number of participants and the amount of the currency handled through its own payment and clearing network, the Cross-border Interbank Payment System ( Cips ), reached a new high in 2024, according to data from the Cips website. Additionally, the buoyant issuance market for panda bonds in 2024 also played a key part in this internationalization blueprint.

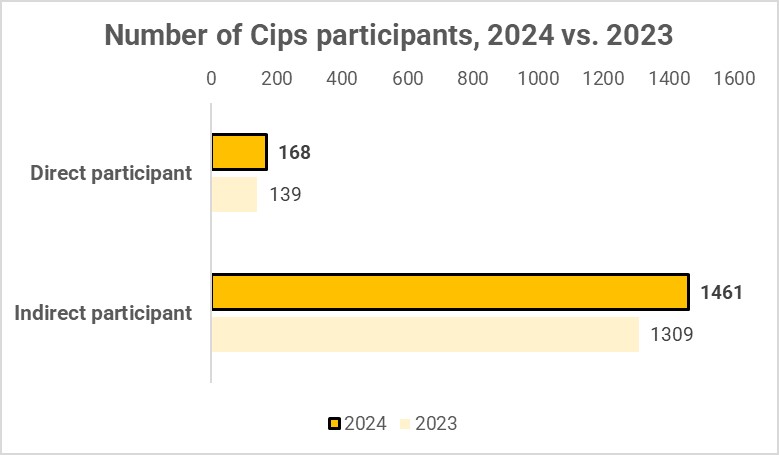

The number of direct participants of Cips, that is, banks that can process and settle cross-border renminbi payments for themselves and on behalf of the indirect participants, has grown to 168 in 2024, up from last year’s 139, marking a 20% increase year-on-year. Notably, 76% of these new joiners are overseas banks, including HSBC Hong Kong, which is by far the largest foreign banking institution in terms of the cross-border renminbi clearing size.

Meanwhile, the number of indirect Cips participants has also grown by 169 to 1,461 in 2024, with 94% of the new joiners being overseas banks. Together, the direct and indirect participants of Cips distribute across 119 countries and regions over the world, with over 4,800 banking entities providing cross-border renminbi services in 185 countries and regions.

Data source: Cips

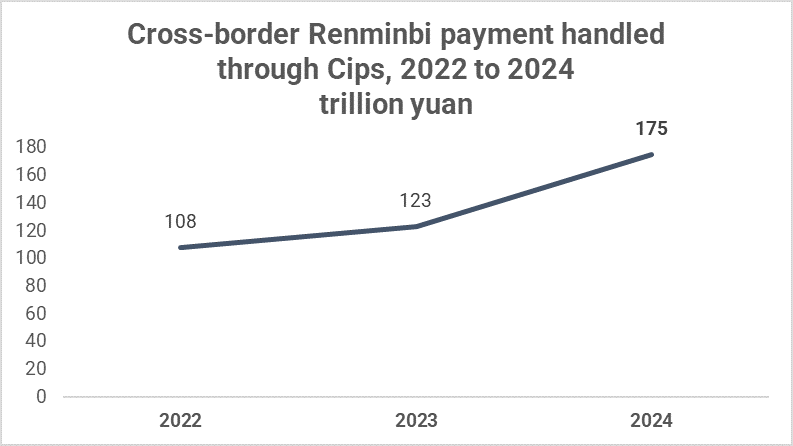

As well, the expanded payment network also experienced an increase in the number and size of cross-border renminbi, or yuan, transactions, amounting to 175 trillion yuan ( US$23.8 trillion ) in 2024 and a year-on-year growth of 43%. The three-year compounded annual growth rate from 2022 to 2024 averaged out at 30%, showcasing the growing activeness of the Chinese currency in the international market.

The Cips, which is supervised by the People’s Bank of China ( the central bank ) and was launched in 2015, marked its 10th anniversary in 2024 with over 600 trillion yuan of cross-border business being handled through the system throughout the period, making it a pivotal corridor of the renminbi’s cross-border payment and clearing, and a key enabler for its internationalization.

Panda bond record issuance

Apart from the increased usage of renminbi in cross-border payment, increased capital raising by foreign institutions through renminbi-denominated bonds in China, nicknamed panda bond, is also a powerful engine boosting the currency’s internationalization.

In 2024, there were 109 issuances of panda bond totalling 194.8 billion yuan in 2024, according to Chinese financial data provider Wind, marking a 16% increase in terms of number of deals and a 26% increase in deal value, both record highs, reflecting investor appetite for this financial instrument and a favourable sentiment towards China’s capital markets in general.

Data source: Cips

Looking forward into 2025, the panda bond market is expected to continue on a bullish trend as China’s central government has decided to pursue an easy monetary policy, meaning the funding costs of panda bonds will decrease following likely rounds of reduced renminbi interest rates.