now loading...

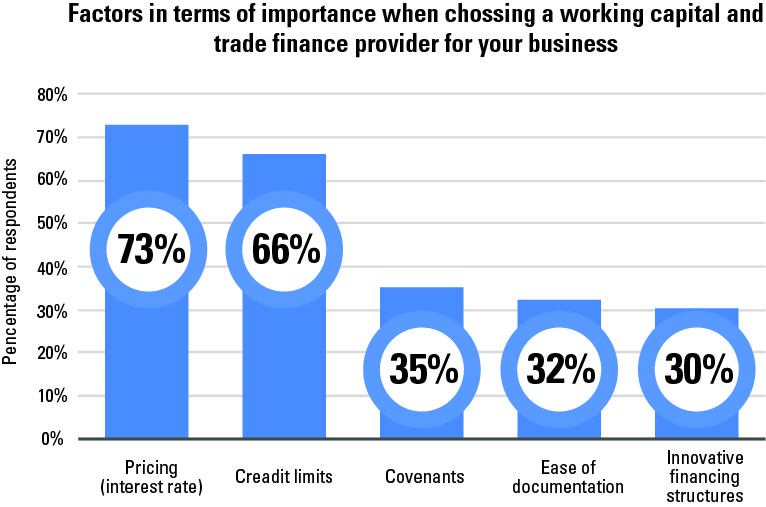

While blockchain-based solutions and electronic trade documentation are useful functions, cost of financing is still of utmost importance for CFOs and treasurers when selecting a trade finance bank to work with.

This is according to Asset Benchmark Research's (ABR) 2019 Treasury Review survey of close to 800 participants, which revealed that pricing along with credit limits were key considerations in choosing a service provider. China-based participants were slightly more interested in the credit limits being offered by banks compared to other participants who expressed a demand for more bank balance sheet support with their respective projects.

View from Standard Chartered

Banking services, including credit limits and funding are enablers for business to address working capital gaps and help to facilitate growth. It is therefore no surprise that a key theme for CFOs and treasurers relates to the cost of securing these enablers (trade and working capital services, limits, funding etc). It also therefore follows that the more a banking provider understands its client’s organisation ̶ its processes and underlying businesses ̶ the better the banking provider is able to manage risk appetite and financing terms.It also stands to reason then that price (and to a lesser extent available credit limits) would be the key factors determining the choice of partner, particularly for run-of-the-mill trade and working capital finance facilities. It is however also important to consider the all-in value proposition offered by banks. For example, in addition to providing support Letter of Credit Advising, Confirmation Negotiation and Discounting, banks can also offer discrepancy analysis and training services to enhance document risk mitigation, and in doing so improve Turn Around Times.While pricing and cost of services are a key priority for clients, it’s a symbiotic relationship, whereby the length of relationship and understanding of the clients’ underlying businesses enables a bank to provide more generous conditions and pricing, especially if there are multiple products from across various banking divisions in use by that client.Technology is another consideration for businesses and their banks. As the International Chamber of Commerce (ICC) Banking Commission’s annual report on global trade revealed, an estimated four billion documentary pages are floating in the trade finance space resulting in inefficient processing and additional costs for businesses and their banks.A bank’s digital trade capabilities could create even more potential value, well in excess of any minor pricing variations, when they deliver an enhanced level of standardisation, automation and control. Solutions such as blockchain, open APIs, OCR/NLP are helping to drive operational efficiencies in trade, and possibly differentiate costs while also opening up new revenue streams. While it is often difficult to quantify, it is widely recognised that efficiency is gained through process digitalisation/automation, which in turn drives significant operational cost savings. Banks, including Standard Chartered, are developing API strategies, deploying OCR/NLP and forming collaborations, such as the one we recently announced with SAP Ariba or becoming part of trade finance consortiums such as Voltron.Another big lever is data – data has been referred to as the new oil of banking. Data models and the use of Artificial Intelligence (AI) are just about starting to be explored by banks both for risk mitigation (fraud and AML) and deciding credit risk appetite/limits etc. Creative use of data and AI will be a key enabler especially in the SME or mid-cap space where automation of both service delivery, risk decisions and post sales service will be key to building and sustaining scale.